Top Tech Companies (176)

Don't see your company?

Create a company profileLamassu creates and distributes Bitcoin machines. Our goal is to harness the technological supremacy of cryptocurrencies and provide this same experience to those who’ve never had access to basic financial services in the past.

GiveCard gives debit cards to the homeless. We are innovating the way we donate by going cashless. Our online portal can be used to send donations directly to specific homeless people. These donations can only be spent on certain goods, and the donor can track where and how the money is spent.

oneZero Financial Systems is a leader in financial technology development. Our mission is to empower all brokerages to accelerate their growth with trading technology, connectivity, infrastructure and market access to compete in the foreign exchange, commodities, cryptocurrency and futures markets.

Own Up is a well-funded, Boston-based fintech startup that exists to make sure home buyers get the best deal on their mortgage. We’ve created a new way for consumers to finance their home through the use of innovative technology and unbiased mortgage expertise.

At State Street, we partner with institutional investors all over the world to provide comprehensive financial services, including investment management, investment research and trading, and investment servicing.

We are Fidelity Labs, Fidelity Investments’ in-house fintech incubator. We respond to our customers’ most complex challenges with new solutions—and bring these to scale. The most promising concepts will scale within an existing business unit, or as a new standalone Fidelity venture. To learn more and see open roles, see: https://labs.fidelity.com/careers

Hemista is a first of its kind Robo Advisor which caters to the specific investment and financial planning needs of Immigrants living in the United States. Our investment platform operates based on our proprietary Cross Border Robo Advisor Algorithm.

DepositLink is a simple, secure and efficient way for real estate companies and escrow holders to collect earnest money deposits and commissions electronically through the ACH network. Our mobile responsive website solution eliminates wire fraud and check handling liabilities for real estate companies. DepositLink's admin-level reporting removes the uncertainty associated with unidentified checks, allows authorized company personnel to view the status of all transactions in real-time, and accurately reconciles bank accounts. DepositLink increases efficiencies for both accounting staff and agents thereby enhancing service levels for their clients. Join us in our mission to eliminate paper checks and wire fraud from the real estate industry.

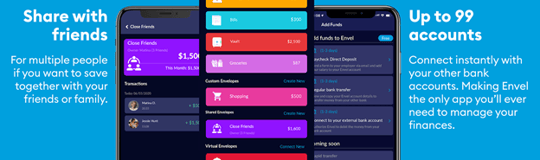

At Envel, we’ve built an amazing one-stop mobile banking app powered by AI that organizes your money automatically for you in up to 99 FDIC insured bank accounts.* We believe that the consumer banking system is broken and no longer focuses on serving its customers. Traditional banks profit from getting you indebted and don’t offer you the freedom or advice to help organize and manage your money in a way that helps you. We have engineered some incredible patent-pending features never seen before in banking to help you become financially fit and achieve your dreams.

FutureFuel.io exists to answer the student debt crisis with innovative, technology-driven solutions. The FutureFuel.io platform connects recent grads who have student debt with employers offering meaningful student debt repayment. Competition for top talent means student loans can be paid off in a few years, not a few decades.

Shoobx is a legal process engine built to simplify standard corporate workflows so entrepreneurs can focus on what they care about most: their company. Managing a business should be done through one login, with the ease of use we have come to expect from the web, not through expensive manual legwork. Shoobx empowers all parties—from employees to investors—to engage more effectively with the company. Shoobx supports a company's Corporate Governance, Equity Management, Human Resources, Collaboration with Legal and more from incorporation to exit.

We provide Instant Equipment Financing Quotes from Leading Finance Companies. LeaseQ is the fastest and safest way to get competitive equipment financing quotes from leading finance companies and submit a pre-qualified application with the finance company you choose... all in less than 2 minutes. No sales reps. You're in control. Fast, Easy, Free! LeaseQ’s free proprietary comparison shopping and lease rating platform is a cloud based SaaS solution that enables: 1) Businesses looking for equipment financing to find the best leasing plans and rates in less than two minutes; 2) Dealers to get rates instantly so they can close sales while a prospect is still in the dealership; and 3) Leasing Companies to generate instant quotes and cost effective qualified leads.

We have developed the first proven analytic platform to deliver credit and marketing scores for consumers using mobile phone behavior data. We use these scores to unlock the potential of financial inclusion for billions of consumers globally and we serve our customers with solutions such as airtime credit, cash loans, and handset finance.

At Notarize, we’re pulling the future closer, bringing industries like real estate, automotive, and financial services into the digital age. We’re the first company to complete a legal online notarization, online mortgage closing, online will, online auto sale, and countless other critical transactions. We’re proud to play an integral role for our customers -- from individuals to major enterprises -- in making life’s most important moments better.

We help financial services firms and insurance companies communicate more effectively with their customers and financial advisors. We do so by evaluating call center service, client reporting, web and mobile sites as well as any other way financial services and insurance companies communicate with their “clients”. We report back to our clients on what they are doing well, where they should focus efforts to make improvements as well as where they stand versus their competitors or best in class in the industry.

Blueleaf, a leading provider of Financial Relationship Management Software, is reinventing software for the wealth management industry to deliver an unparalleled growth engine. We are not your fathers client reporting system. Blueleaf has reinvented client reporting to become a proactive growth tool for wealth management firms. Our reporting delivers branded touches to clients automatically, creating client value on behalf of advisory firms and gathering key insights to drive firm growth with unparalleled automation.

Institutional asset managers are extremely frustrated by market structure. We founded Tripleshot to help these firms buy and sell equity securities more effectively in today’s challenging markets.

We build secure, finance and risk management solutions for enterprises on our private, permissioned distributed ledger technology, Uplink.

Aiera is an investing and market research platform that leverages deep-learning and advanced computational linguistics to combine with leading analysis methods. For investors, Aiera offers actionable calls, specified conviction, and written research identifying key investment themes.

This start-up is aimed at creating a business to tap into the P2P lending industry in the US with an innovative business model. Success would depend on creating analytical models for customer pools, that will inturn maximize the ROI for borrowers and Lenders.This would be a digital model with AI and machine learning enabled customer experience